|

|

| Browse | Ask | Answer | Search | Join/Login |

|

|

||||

|

Journalizing Entries for returned/damaged goods.

I am just a bit confused on this. Here is the problem.

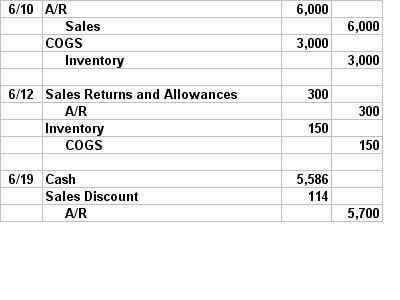

Damaged goods totaling $300 are returned. The scrap value of these goods is $150 Now looking back in the book, it says: If goods are returned because they are damaged the entries should be made for their estimated value. So far I have this, but it doesn't look right. It seems that I am still $150 off somewhere. Sales Returns and Allowances DR 300 A/R (to record credit to buyer) CR 300 Merchandise Inventory DR 150 COGS (cost of damaged goods) CR 150 Is this right, or am I missing something? Could someone explain this a little better for me? |

||||

|

||||

|

It could be journalised as the difference between the retail cost and the wholesale cost on returned goods. |

||||

|

||||

|

Okay, I think I understand it now. The sales return and CR to A/R were for the selling price of the items, and the Inventory and COGS entry were at the original price of the items, not the selling price. So if $3000 of items were sold for $6000 with terms 2/10 n/30, damaged goods are returned with a selling price of $300, scrap value is $150, then payment is received it would look like the figure below? I think what was throwing me off was that scrap value. I guess I thought the damaged items were returned then sold for scrap.

Thanks for the help.

|

||||

| Question Tools | Search this Question |

Add your answer here.

Check out some similar questions!

Does anybody else ever feel like they're "damaged goods" and that they don't really deserve to be in a long-term relationship or in a marriage?:(

Hello, We recently started the paperwork for a new house in Sacramento, CA being built by SHEA homes. After the papers were signed, we paid a deposit of $10,000 to the builder. Due to an unforeseen event we had to back out of the deal. The builder is refusing to pay the initial deposit back to...

I need help journalizing these two entries: If you can help, please let me know MAY 1 2006 23. Served as a disc jockey for a party for $1,560. Received $400, with the remainder due on June 4, 2006. 30. Served as a disc jockey for a charity ball for $1200. Received $600, with the...

I purchased a home and after the contract for the sale was executed, the sellerís wife contacted me and asked me if I was interested in purchasing the new custom draperies that were on the windows. She told me that she wanted $1,700. I agreed and told her that I would pay her separately at...

In New York State what is the legal procedure to collect on a bad check? I was told you need to send a registered letter to give time to pay on check, and what if the person who gave the check never receives any notice ? What rights do they have?

View more questions Search

|