|

|

| Browse | Ask | Answer | Search | Join/Login |

|

- It's not about the current level of interest rates.

- It's not about whether the economy is currently expanding or contracting.

- It's not about whether Government revenues have increased in the last several years.

- It's not about the current level of government spending.

- It's not about the allocation of government spending between competing needs and priorities.

|

||||

|

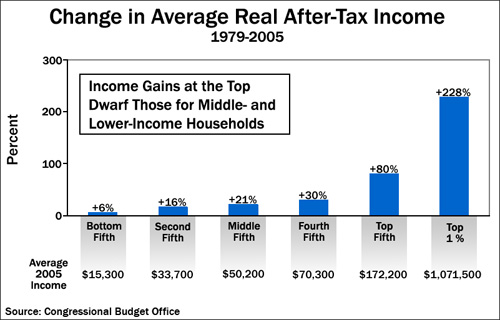

I contend the tax cuts made the rich a whole lot richer. In fact, they made MORE than the poor LOST. Indeed. They got SOOOOOO much richer that their additional wealth skewed the numbers so that it only APPEARS that we're in an expansion. Ok, let me rephrase that. The expansion that's occurring, if there is one, is being shared by only a very few individuals. Those wealthy people made their money off someone's back. Given the tax cut they got, I think I know who. The middle class is getting poorer by the minute. Jobs are going overseas; food is going through the roof. They can't afford to put gas in their cars, and of course, the job they had building cars has turned into a job selling TV's for Wal-Mart. I know you don't think deficits matter. So, you just ignore them. You know that Republicans have been spending YOUR money like drunken sailors. But, you evidently think there's no piper to pay for all that fiscal irresponsibility. I don't know why. That's why you can say we're expanding, and say it with a straight face. excon |

||||

|

||||

|

The relevant question is whether they caused Federal Government revenue to increase more than it would have without them. The answer to that question is clearly and unambiguously, NO. Yes, the recovery would have been less rapid without them, but it still would have occurred. Government revenues would have been greater, and would have covered more of the increased spending, thus producing a lower deficit in the intervening years. There is no serious disagreement about this among reality-based economists, regardless of their ideological bent. The hidden costs of these deficits are now coming home to roost big-time as interest rates have increased from the historic low levels they were at while much of the debt was being accumulated. We're now paying significantly higher rates on a much larger total debt, so the cost of this irresponsibility is just starting to be felt. Over the coming years, these debt-service payments will reduce the funds available for all government services, and the "giant sucking sound" of the Federal Hog at the credit trough will drain credit away from productive private-sector investments. No amount of lipstick can turn this pig into a ballerina, despite the best efforts of a hard-core remnant of faith-based supply-siders. It's been a great ride, I know, but the jig is up. |

||||

|

||||

|

|

||||

|

||||

|

Listening to people like Lou Dobbs, John Edwards and Mike Huckabee lamenting the plight of America's middle class and poor, you'd have to conclude that things are going to hell in a handbasket. According to them, there's wage stagnation, while the rich are getting richer and the poor becoming poorer. There are a couple of updates that tell quite a different story.

The Nov. 13 Wall Street Journal editorial "Movin' On Up" reports on a recent U.S. Treasury study of income tax returns from 1996 and 2005. The study tracks what happened to tax filers 25 years of age and up during this 10-year period. Controlling for inflation, nearly 58 percent of the poorest income group in 1996 moved to a higher income group by 2005. Twenty-six percent of them achieved middle or upper-middle class income, and over 5 percent made it into the highest income group. Over the decade, the inflation-adjusted median income of all tax filers rose by 24 percent. As such, it refutes Dobbs-Edwards-Huckabee claims about stagnant incomes. In fact, only one income group experienced a decline in real income. That was the richest one percent, who saw an income drop of nearly 26 percent over the 10-year period. The editors explain that these people might have been rich for a few years, had some capital gains, or could not stand up to the competition with new entrepreneurs and wealth creators. The U.S. Treasury study confirms previous studies dating back to the 1960s, concluding, "The basic finding of this analysis is that relative income mobility is approximately the same in the last 10 years as it was in the previous decade." As such, it points to a uniquely American feature: Just because you know where a person ended up in life doesn't mean you can be sure about where he started. Most of today's higher income and wealthy did not start that way. What about claims of a disappearing middle class? Let's do some detective work. Controlling for inflation, in 1967, 8 percent of households had an annual income of $75,000 and up; in 2003, more than 26 percent did. In 1967, 17 percent of households had a $50,000 to $75,000 income; in 2003, it was 18 percent. In 1967, 22 percent of households were in the $35,000 to $50,000 income group; by 2003, it had fallen to 15 percent. During the same period, the $15,000 to $35,000 category fell from 31 percent to 25 percent, and the under $15,000 category fell from 21 percent to 16 percent. The only reasonable conclusion from this evidence is that if the middle class is disappearing, it's doing so by swelling the ranks of the upper classes. What about the concentration of wealth? In 1918, John D. Rockefeller's fortune accounted for more than half of one percent of total private wealth. To compile the same half of one percent of the private wealth in the United States today, you'd have to combine the fortunes of Microsoft's Bill Gates ($53 billion) and Paul Allen ($16 billion), Oracle's Larry Ellison ($19 billion), and a third of Berkshire Hathaway's Warren Buffett's $46 billion. In 1920, America's richest one percent held about 40 percent of private wealth; by 1980, the private wealth held by the richest one percent fell to about 20 percent and has remained stable at that level since. Demagogues duping Americans about stagnant and declining income give politicians justification to raise taxes and place regulatory obstacles in the path of risk-taking, productivity and hard work that will impede the enviable income mobility that has become a part of American tradition. Raising taxes on capital formation reduces the rate of capital formation. Raising taxes on income reduces incentives to work. Unfortunately, because so many Americans buy into the politics of envy, politicians have a leg up in enacting measures that cripple economic growth. |

||||

|

||||

|

No, Tom, the endorsement of Mitt Romney does not mean that much to me. I was surprised about McCain's endorsement though. Still, that does not move him up or down my opinion poll. Same for Mitt.

I share some of the same views my favorite cranky old lady shares, as posted below: |

||||

|

||||

|

And my New Year's wish is that all the Republicans continue to grovel and pander to the self-anointed prophets of the Religious Right, oblivious to the broad electorate's hunger for competent, non-ideological governance. They need to spend some time in the wilderness searching their souls and regaining their integrity.

|

||||

|

||||

|

|

||||

|

||||

|

What is your evidence for the statement that the middle-class and lower class are getting poorer while the rich get richer? To the contrary, there is ample statistical evidence that while the rich are indeed getting richer, the poor and middle classes are also getting richer. The gap in the distribution of wealth is getting smaller, not larger. All you need to do is look at census data, including salaries, benefits packages, labor costs, etc. The information is available from the Bureau of Labor Statistics and the Census Bureau websites. It shows that the disparity in salaries is DECREASING, not increasing. And it shows that the disparity is decreasing, not because the high salaries are getting lower, but because the low salaries are getting higher. I have posted these statistics a number of times in the past, and I don't really have time to do it again right now. But the information is there if you want to see it. Sorry, I don't buy your argument. It lacks evidence. Elliot |

||||

|

||||

|

These are all interesting and important topics, but they are not the subject I'm addressing. The topic I'm addressing is responsible government budgeting. That means the Government should not spend GROSSLY more than it receives in revenue, for many years at a time. When it does so, it causes interest rates to be higher THAN THEY OTHERWISE WOULD BE, and credit to be less available for private-sector investment THAN IT OTHERWISE WOULD BE. It also seriously compromises the ability of future governments to meet the needs of the nation. Of course it's true that even WITH a balanced budget, the Government could still spend either too much (providing too many low-value services) or too little (failing to provide critically needed high-value services). It's also true that even with a balanced budget, the Fed could set interest rates too high (causing a recession) or too low (causing inflation). But at least there wouldn't be the necessity for massive government borrowing that distorts both credit markets and product markets in fundamental ways. And for what it's worth, even though it's off-topic, I agree with you that the Fed's recent panicky efforts to inject money into the system are probably inflationary, i.e. current interest rates are too low. |

||||

|

||||

|

|

||||

|

||||

|

Income Inequality Hits Record Levels, New CBO Data Show, 12/14/07

The CBO data do not provide a direct measure of the impact of these tax policy changes because they reflect the impact not only of legislative changes but also of changes in household incomes and other factors that influence tax payments. Direct estimates by the Urban Institute-Brookings Institution Tax Policy Center that consider only the impact of the recent tax policy changes provide definitive evidence that the recent tax cuts have widened income inequality. The Tax Policy Center has found that as a result of the tax cuts enacted since 2001:[6]

* Households in the bottom fifth of the income spectrum received tax cuts in 2006 that averaged $20 and raised their after-tax incomes by an average of 0.3 percent. * Households in the middle fifth of the income spectrum received tax cuts averaging $740 that raised their after-tax incomes an average of 2.5 percent. * But the top 1 percent of households received tax cuts averaging $44,200 in 2006, which increased their after-tax income an average of 5.4 percent. * And households with incomes exceeding $1 million received an average tax cut of $118,000 in 2006, which represented an increase of 6.0 percent in their after-tax income. That is more than double the percentage increase received by the middle fifth of households. [7]  The Distribution of the 2001-2006 Tax Cuts: Updated Projections, November 2006

The long-term effect of the 2001-2006 tax cuts on the distribution of income will depend on how they are paid for, but their immediate effect has been skewed in favor of those with high incomes. In 2006, for example, the tax cuts are equivalent to 2.5 percent of after-tax income for the middle quintile of the income distribution compared with 4.1 percent of income for those in the top quintile. Households in the bottom quintile receive a benefit of 0.3 percent of income. For taxpayers in the top one percent, the benefits are scheduled to increase even more as additional cuts ó primarily to the estate tax ó phase in between now and 2010. Compared to pre-EGTRRA law, taxpayers in the top one percent will enjoy a 5.4 percent increase in after-tax income in 2006 and a 6.7 percent increase in 2010.

|

||||

| Question Tools | Search this Question |

Add your answer here.

Check out some similar questions!

Is Iowa considered democratic or republican

ABC News: 9/11 Firefighters Plot Anti-Giuliani Ads So if Rudy is a tool and Hillary is a socialist who's left for the media to push onto the public?

"Strategists for Rudy Giuliani are quietly preparing a significantly *race-based campaign* strategy to strengthen support among socially conservative white voters, in the South as well as in the North. The former Mayor carries the burden of three marriages and a Brooklyn accent, but he has more...

What is the budget for a advertising campaign

When an candidate decides to no longer run for office either drops out or isn't running for the next term, does he/she get to keep the money raised on their behalf? If not, what happens to it? Thank you.

View more questions Search

|