|

|

| Browse | Ask | Answer | Search | Join/Login |

|

|

||||

|

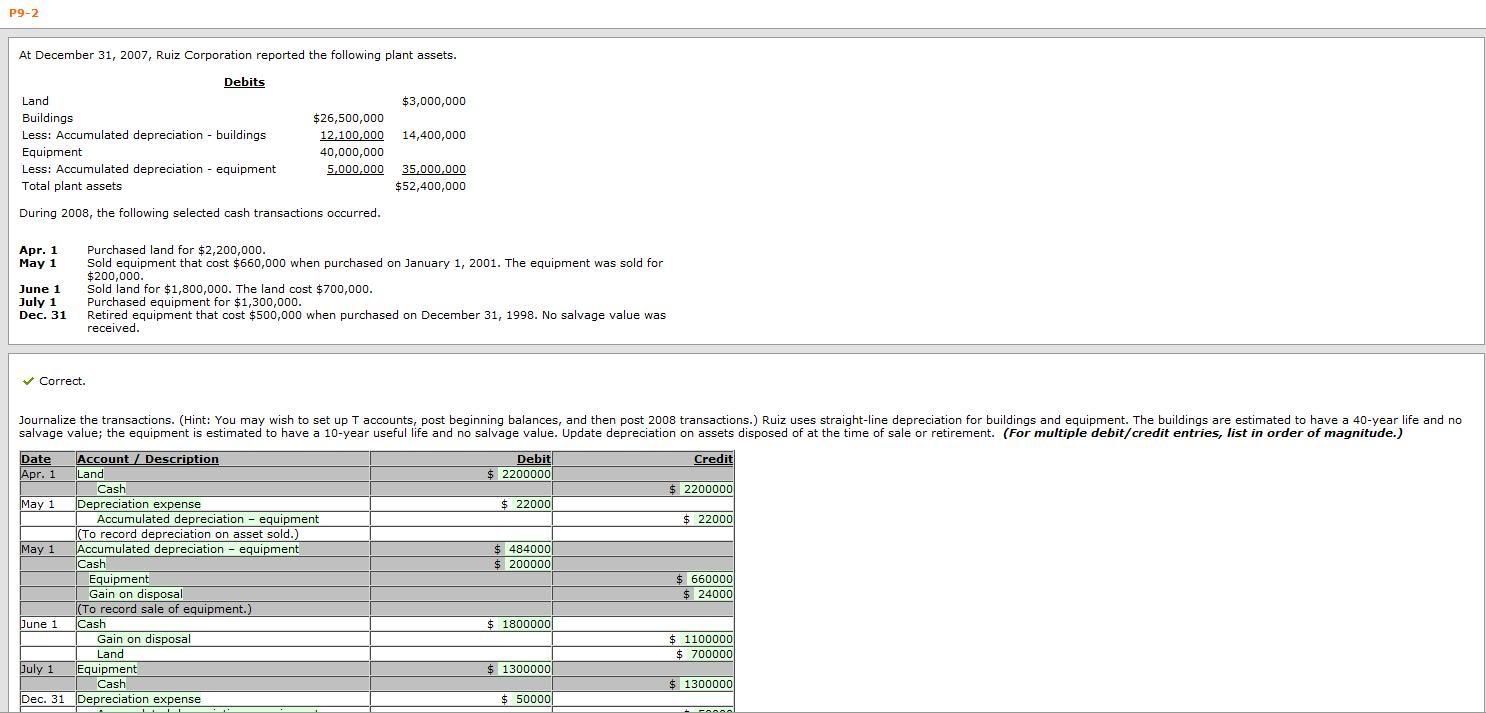

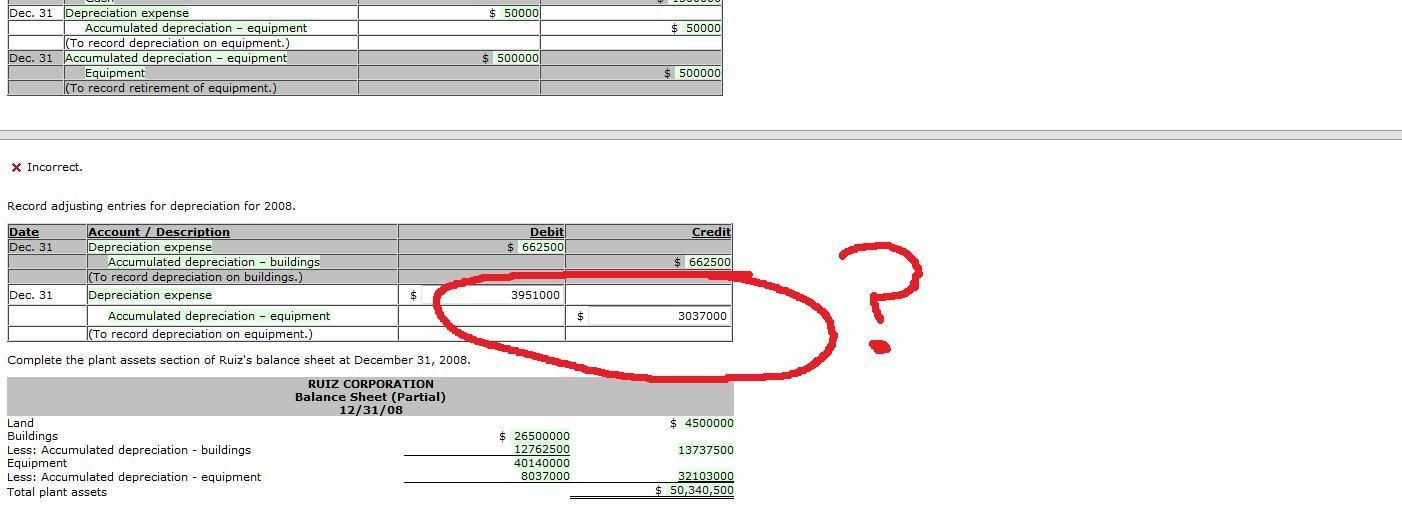

You did so well on everything else I'm a bit surprised this was messed up. First, it doesn't balance, which is a no-no right there. You've got the equipment updated to 40,140,000, (which is correct) and it's all straight-line for 10 years with no salvage. It's fairly straight-forward. What did you use to come up with your answer, and why are the debits & credits different? (P.S. See the correct answer below. Apologies. I was trying follow this on the screen and I usually write stuff down so I don't miss something.) |

||||

|

||||

|

First of all, the entry is not balancing.

The depreciation expense that should be recorded for the equipment is as follows: - You should record depreciation expense related to the equipment purchased on July 1(1,300,000/10)130,000 yearly depreciation (130,000/12*6 months from july1 to December 31)= 65,000 - After all the transactions mentioned the cost of the equipment will be as follows: B.balance 40,000,000 Minus: 660,000 Minus: 500,000 The balance that should be depreciated 38,840,000.(Note that I did not add the 1,300,000 newly purchased equipment because I calculated the depreciation related to it above) We divide this amount by 10 years to get the depreciation expense for the old equipment(38,840,000/10)= 3,884,000 then we add to this amount the depreciation expense related to the purchased equipment 65,000. So we will get 3.949,000and the entry will be: Dr. depreciation expense 3,949,000 Cr. Accumulated Depr. 3,949,000 |

||||

| Question Tools | Search this Question |

Add your answer here.

Check out some similar questions!

I have accumulated depreciation and depreciation expense. Do they go together on the Asset side of the balance sheet? My balance sheet is not balancing! The accumulated depreciation is subtracted from the assets on my balance sheet. If I add the depreciation expense to the assets, my balance...

Depreciation Expense and Accumulated Depreciation are classified,respectively, as: a. expense, contra asset b. asset, contra liability c. revenues, asset d. contra assest, expense I think it is A

Depreciation Expense and Accumulated Depreciation are classified, respectively, as

The amount of depreciation expense for a fixed asset costing $95,000. with an estimated residual value of $5,000. And a useful life of 5 years or 20,000. Operating hours, is $21,375 by the units of production method during a period when the asset was used for 4,500 hours I need help to determine...

View more questions Search

|