|

|

| Browse | Ask | Answer | Search | Join/Login |

|

|

||||

|

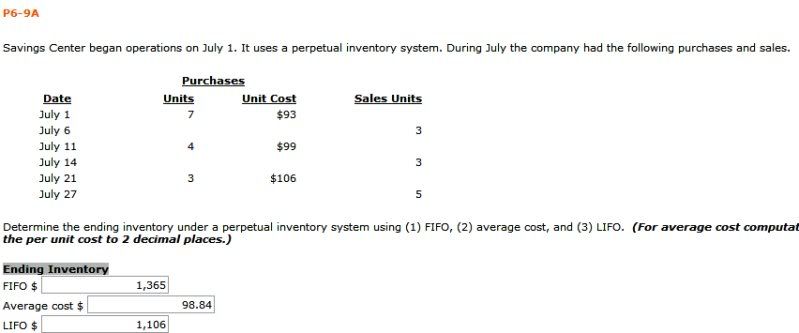

Determine the ending inventory under a perpetual inventory system

Hi ! I've honestly spent a long time trying to figure this out, but I keep getting the answer wrong and I'm not sure how I should go about this question. I'm not asking for you to just give me the answer, if you have time to give a little explanation that would be nice so I could understand what I'm doing :) thanks !

|

||||

|

||||

|

try this: Fifo - first in first out first example. 7/1 - 7 @ $93 7/6 - sold 3 4 @ $93 remain 7/11 - 4 @ $99 7/14 - sold 3 (@ $93) 7/21 - 3 @ $106 7/26 - sold 5 (1 @ $93, 4 @ $99) Looks like you have ending inventory of 3 @ $106 Lifo - last in first out 7/1 7@ $93 sold 3 @ $93, remaining 4 @ $93 7/11 - 4 @ $99 7/14 - sold 3 @ $99, remaining 1 @ $99 7/21 - 3 @ $106 7/27 - sold 3@ $106, sold 1 @ $99, sold 1 @ $93- Inventory 3 @ $99 Average cost average cost of 14 units is $1365 / 14 = $97.50 3 units left = $292.50 |

||||

| Question Tools | Search this Question |

Add your answer here.

Check out some similar questions!

How is the cost of goods calculated using the perpetual inventory accounting system

Hello- Please help with this scenario below International Galleries, Ltd. which maintains a perpetual inventory system on its works of art, has just sold for $5,000 cash a painting which it originally purchased on account for $3,000. In the journal below, record the sale...

Nagle company purchased $2,500 worth of merchandise, terms n/30, from the Crafton Co on June 4. The cost of the merchandise to Crafton was $1800. On June 10, Nagle returned $350 worth of goods to Crafton for full credit. The goods had a cost of $225 to Crafton. On June 12, the account was paid...

Apr 2. Britt received an $18,000 invoice from one of its suppliers. Terms were 2/10 n/30, FOB shipping Point. Britt paid the freight bill amounting to $2,000. 4.Britt returned $2,500 of the merchandise billed on April 2 because it was defective. 5. Britt sold $8,000 of merchandise on account,...

View more questions Search

|